Dynamic Forces Swashbucklers the Saga Continues 2 Cover

Part one of this series on capitalism and democracy probed the famous remark of the American economist and sociologist Thorstein Veblen that there are historical moments when 'democratic sovereignty' is converted into 'a cloak to cover the nakedness of a government that does business for the kept classes'. Part 2 extends this formulation, to ask what happens when democracy is overpowered by capitalist markets.

The Polish-born journalist Willi Schlamm, a free-market conservative who was once a card-carrying communist, famously quipped that 'the trouble with socialism is socialism. The trouble with capitalism is capitalists.' The quip invites a rider: 'And the trouble with capitalists is that without democracy they bring trouble to both capitalism and democracy.'

To understand why market-driven capitalism functionally needs democracy to correct the precipitate and predatory behaviour of capitalists, we need to dwell for a moment on the phenomenon that I have elsewhere called democracy failure. Economists indebted to the work of Francis M. Bator conventionally speak about market failures. But there's plenty of evidence of moments when the failure to apply toothy mechanisms of democratic scrutiny and restraint of reckless markets induces their dysfunction, or outright breakdown. In these circumstances, democracy failure breeds market failure; and market failure then breeds other forms of democracy failure, such as widening gaps between rich and poor.

Not to be confused with social democracy and communism and their schemes of government intervention and centralised state control of an economy, democracy failure can be defined as the political unwillingness, and the political defeat of promises, to tame the arbitrary power inherent in capitalist markets, and to bring greater equality to the lives of citizens. Practically every democracy on the face of our planet is today suffering democracy failure in this sense. But what does democracy failure actually mean in practice? How exactly does it produce market failure?

Clues can be found in a couple of topical examples. Consider the harmful dynamics that are endemic within the food production and distribution chains that span our planet. Every transaction within these highly complex and typically arcane supply chains doubles as an opportunity to cheat. For the moment, watchdog bodies such as the Aquaculture Stewardship Council and the Belfast-based Institute for Global Food Security are in short supply on the ground. National governments constrained by borders often lack the will and the means to tackle with the problem. It therefore comes as no surprise that publicly un-monitored food supply chains are highly vulnerable to such market dysfunctions as horsemeat scams and 'gutter oil' swindles led by market fraudsters and organised crime.

The modern history of banking and credit institutions is an equally troubling instance of democracy failure. During the past several decades, especially in the Atlantic heartlands of the global finance sector, un-elected regulatory bodies, elected governments and rating agencies such as Standard and Poor openly tolerated the practice of dispersing credit risk by selling it on to third party investors. The so-called regulatory system ended up producing the near collapse of the whole banking and credit system. Collateral debt obligations, mortgage-linked securities and other new-fangled instruments encouraged investment firms, hedge fund operators and banks such as Lehmann Brothers and the Royal Bank of Scotland to engage in reckless market adventures.

As we now know, to most people's cost, these foolish corporate swashbucklers produced destabilising effects on the whole global economy. Millions of people are still suffering the consequences of their idiocy. The damage inflicted on markets and civil societies has prompted financial regulators around the world to force big banks to raise their capital levels and improve the liquidity of their funding sources. New laws (such as the Dodd–Frank Wall Street Reform and Consumer Protection Act [2010] in the United States) have been passed. But the application of monitory instruments to this sector has by and large been extremely limited. Democracy failure continues to happen.

Big banks have mostly not been broken up. Some risk-producing giants, including J.P. Morgan, have actually grown much fatter since the onset of the crisis that began in 2007 and 2008. The people responsible for the serious social and political damage caused by the near-collapse of the financial sector have meanwhile remained largely untouched by courts of law. Their companies were deemed too big to fail. They are still regarded by politicians and judges as too big to jail.

The failure of democratically elected governments and other political forces to build new mechanisms of monitory democracy into the banking and credit sector ought to worry all democrats. Yes, neo-liberal economists like to tell us that financial markets, like other forms of markets, are guided by rational calculations that keep things more or less in permanent and dynamic equilibrium. Events of the past decade - and the whole history of financial markets - suggest exactly the opposite conclusion. Within markets as a whole, risk taking, recklessness and broken promises, especially within the aggressive banking and credit sector, are neither predictable nor controllable by market forces alone. Financial markets are never fully guided by rational calculations that keep things in permanent equilibrium. The evidence, both past and present, is that periodic disequilibrium of financial markets is the normal pattern.

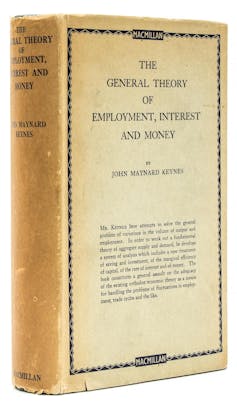

Private banks and credit institutions are especially dangerous. When left to their own devices, they ruthlessly fuel major market movements that tend to take on a life of their own. Investors become entrapped in foolish illusions. In The General Theory of Employment, Interest and Money, published in 1936, John Maynard Keynes called them 'animal spirits'. The phrase is probably an insult to animals, but the point Keynes was making remains valid. He wanted to say that the reckless greed of capitalists tends to seduce other market actors into expecting permanent gains. Market growth takes place – but only until the moment feedback signals driven by actual underlying trends puncture its foolish illusions. When that point is reached, as it did during the 1920s and 1930s, and as it is doing again today, a boom turns into a bust. Citizens lose their jobs, and lose hope. Lives are shattered. Social inequality rises. Democracy suffers. Or it is killed off, or takes its own life in an act of democide.

The positive political point here is that socially damaging market failures can be prevented, or minimised, but only if public watchdogs and other types of early warning and public monitoring mechanisms are built into capitalist market economies. The history of struggles to form trade unions, to establish public inspection boards and German-style co-determination councils shows that sowing the seeds of monitory democracy in the soils of commodity production and exchange is no easy political task. That doesn't make monitory democracy irrelevant, or fanciful. For whenever capitalist markets are not tamed and restrained, democracy failure happens. The scope of efforts by citizens and their chosen representatives to restrain arbitrary power shrinks. Democracy is sabotaged. Vetoed by markets, it is reduced to periodic elections, which in matters of property and wealth distribution change little, or nothing at all. Democracy is made to look feeble and fragile. It is seen as a class weapon, an instrument in the hands of the rich for taming and controlling the poor.

That is not the end of the whole sad saga. For democracy failure can have economic consequences that impact and tear apart the lives of millions of citizens from another direction. Democracy restrained eventually prepares the ground for capitalism unrestrained. Not only do non-elected bodies such as central banks, securities regulators and ratings agencies fail to crack down on fraud, or discourage excessive risk taking, or foster best practice through open-minded counsel, or provide means of redress to those hurt by market failures. Markets once again come to be haunted by the wolfish spirit of inflated expectations, folly and hubris. Just around the corner is the next round of market failures. When at some point they happen, as surely they do, they breed yet more setbacks for the spirit and substance of monitory democracy and its promise of dethroning arbitrary power in the name of greater equality for all. And so the cycle of predatory capitalism and kidnapped democracy continues.

To be continued.

Source: https://theconversation.com/capitalism-and-democracy-part-2-62571

0 Response to "Dynamic Forces Swashbucklers the Saga Continues 2 Cover"

Post a Comment